Sensible Record Of 12 Tax Discount Strategies

작성자 정보

- Shawnee 작성

- 작성일

본문

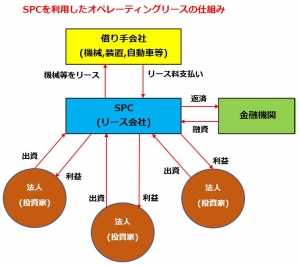

Depending in your particular tax picture, charitable donations might present a good source of earnings tax deductions. One tax-saving strategy is to donate appreciated property. You may take a deduction for the honest market worth and keep away from capital gains tax on the sale. Four. Review interest expenses. If you pay curiosity that isn't tax-deductible (e.g., curiosity on auto loans or credit score cards), consider paying off the debt and as an alternative, using debt that permits for deductible interest (e.g., a home equity loan, the place accessible). A retail firm with numerous retailer leases might have previously benefited from off-stability-sheet financing, presenting a healthier leverage ratio. Below the new standards, the recognition of these leases on the steadiness sheet may considerably enhance reported liabilities, affecting the corporate's debt covenants and potentially its stock worth. Consider a logistics company that leases a fleet of vehicles.

Three. Maximize enterprise tax credit and incentives: Identifying and using tax credits and incentives can supply substantial tax benefits. By benefiting from government credit and incentives, businesses can lower their taxable earnings and general tax legal responsibility. 4. Optimizing your corporation entity structure: Deciding on the appropriate enterprise construction, whether it's a sole proprietorship, partnership, corporation or LLC, can have a considerable impact on tax obligations. 20,000 on the spot asset write-off allows small companies to instantly deduct the complete price of eligible property. This initiative has been prolonged until June 30, 2025, to improve money stream and reduce compliance prices. Evaluate Asset Register - Regularly review your asset register to put in writing off the tax written down worth of scrapped or disposed assets, lowering taxable earnings. Guarantee accuracy, especially for belongings that benefited from the instant asset write-off or momentary full expensing.

Additionally, there might also be adjusted gross income limitations that can apply. For a lot of high earnings earners, discovering deductions you qualify for can seem like extra work than it’s value - but every one provides up. As an example, you can deduct the interest on any mortgage funds for homes you own. 750,000).8 You can also look at tax methods on the state and native ranges. 2. The lessor, on the other hand, is liable for claiming depreciation expenses on the asset being leased. The amount of depreciation that can be claimed depends upon the useful life of the asset, as decided by the IRS. 3. In some instances, the lessor could pass on the tax benefits of depreciation to the lessee in the form of decrease lease payments.

I already employed a CPA, do I nonetheless want a tax lawyer for corporate tax planning? CPAs and tax legal professionals offer companies that can enable you to in your hour of want. Your accountant can handle your each day activities. But, a tax lawyer may need to step in to handle things which might be too complicated for your CPA. Tax lawyers are specialised in navigating sophisticated legal and technical points. Inexperienced finance can also allow lessees to entry inexpensive and flexible leasing solutions for his or her inexperienced assets, to enhance their environmental efficiency and competitiveness, and to adjust to the regulatory and market expectations. Social accountability refers to the obligation and dedication of companies to act ethically and responsibly in the direction of their stakeholders and society, such as their employees, prospects, suppliers, communities, and the general public. Step 3: Apply the formula. Subtract the accumulated depreciation from the asset value to seek out the e-book worth. 40,000. This represents the remaining value of the asset on the company’s steadiness sheet after accounting for the accumulated depreciation. The guide worth is important for figuring out the acquire or loss if the asset is offered.

Depreciation methods can have important tax penalties. Accelerated methods typically provide larger tax deductions within the early years of an asset’s life, which might be useful for decreasing taxable earnings. Larger preliminary deductions can enhance money flow by decreasing tax liabilities within the quick time period. Seek the advice of with a tax skilled to grasp how completely different depreciation strategies would possibly have an effect on your tax situation. The assets may be transferred by lease to a different individual, to a company, to a state, オペレーティングリース リスク or to another jurisdiction. These can be labeled as liquidation gross sales, conversion transactions, foreclosure gross sales and re-allocation transactions. Asset switch taxes are collected in several manners relying on the jurisdiction where the switch takes place. Some jurisdictions require that the seller pays tax on the transferred asset while others require that solely the transferor must pay tax. Just a few jurisdictions also require the transferor to pay taxes on the sale of the asset itself.

관련자료

-

이전

-

다음