Application For Finance Australias Main Islamic Super I Halal Finance I Ijarah Loans Answer

작성자 정보

- Cora 작성

- 작성일

본문

Islamic car finance fits within the broader scope of asset finance, focusing on the tangible worth of the automobile rather than speculative gains. By adhering to Islamic rules, these financing options assure compliance with Islamic law, providing a shariah-compliant car purchase course of. Institutions providing these companies cater to the needs of the group, enabling ethical, transparent, and risk-sharing transactions that respect the tenets of Sharia law. To assure a profitable acquisition of an Islamic car loan, people should meticulously observe a structured set of steps designed to align with Islamic financial rules and facilitate a easy financing course of. Initially, individuals ought to assess their financial capabilities to determine an reasonably priced value range for the automobile.

To finance the car of your selection, ICFAL makes use of Murabaha finance contract. This Islamic contract discloses the price incurred and profit earned during the sale. Once you select a car that you simply want to personal, ICFAL purchases the vehicle from the dealership and sells it to you in installment with a pre-agreed markup.

The funder’s insurers and funder need a valuation report to have the power to assess your software. Paying for a valuation report or for finance processing fee doesn't mean an computerized approval. Initial approval course of which supplies an estimate of how much a potential consumer might receive (before identifying the property to be purchased for the consumer to possess/occupy), based mostly on the data supplied to MCCA. The funder’s insurer or funder can at any time of the application process ask for any info that they deem is required to adapt to their set guidelines. Anyone, Muslim or non-Muslim can apply for finance, however approval of funds is subject to assembly the applicable evaluation standards in drive on the time of software. MCCA’s residential finance product is the leading alternative for Muslims conscious about Shariah necessities relating to their finances.

Driven by our Islamic values and ethos, our Shariah advisors ensure all our products are Shariah compliant. Chose from Islamic car finance on your private or business wants. In addition, the traders are in search of long-term gains and are prepared to simply accept the next stage of market danger and volatility along the way in which. ISRA Consulting as its Shariah Adviser certifies and provides the Shariah Pronouncements of the investments for them to comply with the Shariah Rulebook.

This revenue is transparent and stuck, distinguishing it from interest-based standard loans. Islamic Car Finance provides numerous advantages to Australian residents and traders in search of moral and Sharia-compliant financial options for buying automobiles. As a supplier of halal car finance in Australia, Islamic Car Finance adheres to Islamic finance rules, making certain that each one transactions are ethically sound and compliant with Sharia legislation. Asset-backed Islamic car finance and business asset finance are pivotal tools within Islamic finance, facilitating the acquisition of autos and business property by way of Shariah-compliant financing constructions. In Islamic asset-backed financing, varied modes such as musharakah, mudarabah, and ijarah are commonly utilized to guarantee compliance with Islamic regulation.

Contact us right now and let our professional group help you obtain your financial targets whereas respecting your beliefs. Navigating the journey toward homeownership can seem daunting, particularly when your religion dictates specific financial pointers. A Halal Mortgage is a novel possibility within the Islamic world that enables Muslims to benefit from the luxurious of home ownership whereas being true to their beliefs. Let’s uncover this progressive Islamic finance choice, its operations, and the way the Murabaha transaction flows into the equation. If you’re unsure on whether or not Islamic finance is the proper selection for you and your family, we encourage you to learn by way of our sources. Written by our team of specialists, you’ll get a walkthrough of the ideas of religion primarily based finance and be geared up with all the essentials to grow your private finance knowledge.

Because It Occurred: Residence Loan Lending Slumps, Nation's First Islamic Bank Fails To Get Licence, Asx Closes Larger

Because It Occurred: Residence Loan Lending Slumps, Nation's First Islamic Bank Fails To Get Licence, Asx Closes Larger

MCCA’s industrial finance is the perfect alternative for Muslim individuals or businesses trying to harness the ability of Islamic finance to further their targets by way of property buy or investment. Our phrases are aggressive with one of the best finance choices obtainable on the open market. Our car financing product gives you the chance to get your dream car to drive together with your loved ones. Any info is believed to be correct and present at the date of publication. While all care has been taken within the preparation to make sure the information is right, it could change from time to time.

MCCA’s industrial finance is the perfect alternative for Muslim individuals or businesses trying to harness the ability of Islamic finance to further their targets by way of property buy or investment. Our phrases are aggressive with one of the best finance choices obtainable on the open market. Our car financing product gives you the chance to get your dream car to drive together with your loved ones. Any info is believed to be correct and present at the date of publication. While all care has been taken within the preparation to make sure the information is right, it could change from time to time.

Get the most recent fee updates, monetary information, insights and analysis delivered weekly. According to the Australian Federation of Islamic Councils, as of 2021, different providers of Islamic house financing include Ijarah Finance, MCCA, Hejaz, Amanah Finance, and ICFAL. It’s important to note that being of Islamic religion just isn't a requirement of these making use of for an Islamic home loan.

The order banning Siddiqui from leaving Australia was needed, ASIC argued, due to issues the ex-company boss was a flight risk, noting his historical past of frequent journey and business links to Dubai. Whilst every effort is taken to ensure that rates are up to date, Arab Bank Australia takes no accountability for errors herein. We have guides and different resources that can assist you apply for a new personal loan or manage your existing one. No penalties whenever you make early repayments or exit fees if you repay your loan sooner.

Sharia-compliant financiers are sure by Australian regulations to indicate merchandise on this means. Before we get into the small print of Sharia-compliant finance merchandise, it's important to note that they’re sometimes not referred to as ‘loans’. However, as the phrases ‘financing’ and ‘lending’ are sometimes used interchangeably throughout the Australian financial space, both terms are used on this article.

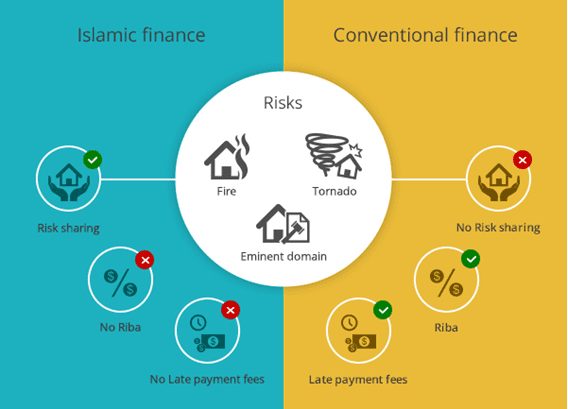

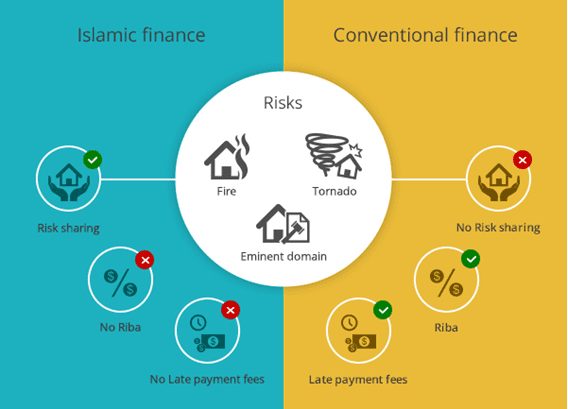

The buyer can then repay this amount in installments, making it a sharia-compliant financing possibility. Unlike standard finance, where the borrower bears a lot of the risk, sharia-compliant car financing includes shared threat between the financier and the shopper. This equitable distribution of threat is essential in sustaining the integrity of the monetary transaction according to shariah.

From there, the process is tailor-made particularly to Islam, together with your financial establishment agreeing to buy it for you. In return, you make a Ijarah Muntahiyah Bittamlik or ‘lease’ agreement to live in the property for an agreed size of time and pay rent to the establishment. One of the most important traits of Islamic financing is that it's asset-backed and asset based financing. The conventional / capitalist idea of financing is that the banks and financial institutions deal in money and financial papers solely. That is why they are forbidden, in most international locations, from trading in items and making inventories.

The revenue that the funder puts on high of the asset’s buy price is for the companies and costs incurred by the funder to safe and purchase the asset. The client will make regular funds to the funder till the acquisition value plus profit margin has been repaid. As with Ijarah agreements, the client does not become the owner until after the finance has been paid in full.

Islamic Residence Loans Study And Examine

They shouldn't be relied on by individuals once they make funding decisions. Provide application documents which will be checked and despatched to credit score manager for approval. Unfortunately, we will ONLY finance for self-employed clients who've an ABN which is trading. We are endeavoring to have a client finance product in January 2025 to fulfill this additional demand Insha’Allah. We are unable to finance vehicles for Uber or Ride Share automobiles, laser hair removal machines (except for Medical Doctors or specialist Skin Clinics), and gym equipment. At Halal Loans, our dedication to excellence goes past words – it’s reflected within the rave reviews from our happy clients.

A residual value is the worth of the car on the finish of the lease time period. The residual value is agreed whenever you take out a novated lease and is used to calculate the month-to-month lease fee. When you choose your car, TFM will advocate a residual value that takes into consideration the make, model and estimated usage.

Our easy asset finance loans will get you behind the wheel quick. Once we’ve verified your data, we’ll give you the loan documentation setting out your rate of interest and other essential info. Keep in mind that the speed proven within the loan documentation is subject to change and could additionally be totally different on the day of settlement. Choose from one to seven years, with weekly, fortnightly or month-to-month repayment choices.

By choosing a respected Islamic finance supplier, Australian residents can safe car financing that meets their religious and monetary requirements. We’re partnered with lenders, insurers and different financial establishments who compensate us for business initiated via our website. We earn a fee every time a buyer chooses or buys a product advertised on our web site, which you'll find out more about right here, in addition to in our credit information for asset finance.

Asset-backed financing serves as an essential instrument in Islamic finance, enabling individuals and companies to entry the mandatory funds with out resorting to interest-based transactions. This type of financing promotes monetary inclusion and economic growth within the framework of Islamic finance principles. You don’t should pay curiosity utilizing the standard PCP or HP, this way.

Accounts, Commerce Finance, Loans, International Trade

Please discuss with our present Personal Banking Booklet (PDF, 1.50 MB) for full particulars. Contact Arab Bank Australia to debate your needs and eligibility for a private loan today. The tech stocks Australia does have have been usually performing well (+0.8%), while healthcare and shopper shares have been additionally solidly greater. Wall Street posted reasonable positive aspects in a single day, and without a massive tech sector, which again drove some of the better rises, Australia's share market is making an much more modest advance. The female participation rate — that is the number of ladies either employed or unemployed as a share of the labour market — is 62.6 per cent, nonetheless lower than the 71.1 per cent for males.

In Islamic finance, interest-bearing transactions are prohibited, as the charging and receiving of interest is con... The concept of empowering communities via moral monetary options has gained vital attention in current years. Ethical financial options goal to not only address the monetary needs of individuals and companies but additionally contemplate the br...

You might want to show that you’re good at managing cash and that you've saved money successfully up to now (which can embrace cash saved in your deposit). The lender will need to be persuaded that your revenue is sufficient to repay the loan over the time period you want. Bear in thoughts that your selection isn't restricted to financial institution based in predominantly Islamic nations. Some of the larger Australian banks additionally provide Sharia-compliant loans.

Financial inclusion is a crucial element for economic development and social progress. It ensures that people and communities have access to the necessary financial tools and assets to enhance their lives and participate totally within the econo... Islamic banking, also identified as Shariah-compliant banking, is a quickly rising sector within the international monetary trade. With an estimated market worth of over $2 trillion, it has gained important attention from both Muslim and non-Muslim consum... Empowering people via monetary education is a vital step towards making a extra financially secure society.

Islamic finance principles, which adhere to the ideas of Shariah law, are more and more being acknowledged as an ethical and sustainable... Sustainable infrastructure improvement is crucial for achieving financial development while safeguarding ethical rules. In recent years, there was a growing recognition of the want to finance infrastructure projects that promote environmental sus... Empowering Rural Communities by way of Islamic Financing SolutionsRural communities in many Islamic nations typically face challenges when it comes to accessing monetary services and sources. Halal financing has emerged as a robust software for empowering Muslim entrepreneurs and unlocking their full potential. By adhering to Islamic principles and avoiding interest-based transactions, Halal financing provides a viable various to tradit...

This aligns with the rules of Sharia law, permitting people to acquire properties without compromising their spiritual beliefs. Initiating the applying process for Islamic car financing requires an intensive understanding of the needed documentation and compliance necessities to ensure adherence to sharia rules. Prospective candidates should first choose a respected car finance provider specializing in sharia compliant finance. Key documents typically embody proof of income, identification, and details of the vehicle to be financed. In conclusion, the concept of Halal Mortgage presents a singular perspective on home financing by aligning with Islamic rules such as equity participation and avoiding interest-based transactions. Understanding these elementary rules is crucial in reaching homeownership by way of Halal Mortgage, which entails distinctive structures and processes.

Islamic Funding Finance Riyadh Islamic Finance

Ali has a wealth of information in residential lending, serving to people and families buy homes and grow investment property portfolios. He is very regarded for his customer service, establishing himself as a friendly and helpful lender. By joining IFIA, you become a part of the founding affiliation committed to shariah compliant asset-based or asset-backed monetary products. IFIA is founded and controlled by key issuers and practitioners who're regulated by compliance frameworks and have Shariah-compliant boards or certifications. Some of Australia’s biggest banks offer Sharia-compliant finance merchandise.

The 10% deposit just isn't required to be paid in till you've obtained a formal approval letter from MCCA. This letter ensures that the finance application has been accredited by all parties to the stated finance facility. MCCA’s residential finance product is the leading alternative for Muslims conscious about Shariah requirements relating to their funds. With no early termination charge and a range of suitable options, it's the finance product to suppose about if you're looking to fulfil your property-ownership targets. The Ijarah Muntahia Bittamleek arrangement has been recognised by a lot of up to date Muslim scholars and is broadly carried out and utilised by Islamic banks and financial institutions around the globe. For nearly a decade, we now have been amalgamating wealth with faith to advance financial development and financial opportunity for all Muslims.

Islamic nations have significant potential for financial growth, and opening new doors to facilitate this progress is of significant importance. One such avenue is the growth of investment opportunities in Halal finance. Ethical financing is a concept that has gained vital attention in recent times as people and organizations attempt to align their monetary activities with their moral and ethical values.

This niche market continues to expand, permitting Muslims to entry companies that align with their religious beliefs. By opting for Islamic car loans in Australia, individuals can fulfill their car possession needs without compromising their religion. As the demand for Sharia-compliant financing grows, extra establishments are prone to offer tailor-made Islamic finance options, contributing to the accessibility and availability of halal monetary choices. Sharia-compliant financing choices provide people a financially moral various within the field of car financing. In Australia, not solely is Islamic car financing is gaining traction, however halal mortgages and sharia mortgages are growing exponentially.

Interest is all over the place – it's tied to residence loans, deposit accounts, bank cards, and is meticulously manipulated by our own central bank. Islamic rules play a big role in shaping the practices of economic transactions for Muslims. However, adhering to those rules can often be difficult because of numerous roadblocks.

Mcca Islamic House Finance Australia Shariah Compliant Halal Finance Muslim Mortgage

The primary eligibility criteria revolve across the applicant’s financial stability and adherence to halal practices. Applicants should present proof of a stable income adequate to cowl the car finance without resorting to interest-based loans, as these are prohibited under Sharia legislation. Additionally, the car being financed must be for private use and shouldn't be involved in any actions deemed haram. Alternatively, in cost-plus financing, the financial institution buys the automobile and sells it to the shopper at the next value, which features a predetermined revenue margin. The buyer can then repay this amount in installments, making it a sharia-compliant financing option. By selecting Halal Mortgage Australia, you're partnering with a company that prioritizes compliance with the highest standards of Islamic finance.

Ijarah Finance operates beneath the principle of Rent-To-Own in any other case generally identified as Ijarah Muntahiya Bit Tamleek – A Lease Agreement with the option to own the leased asset at the end of the lease interval. Buying the car in installment utilizing a halal contract lets you own a car comfortable. Putting Shariah compliance first with none compromise on islamic rules. As you navigate your monetary journey, I encourage you to dig deeper, ask questions, and seek out financial options that align along with your faith and values.

In this weblog post, we’ll discover some of the challenges and potential options for halal car financing. These banks observe Sharia law and provide products which are compliant with Muslim values. Another possibility is to finance your car by way of a web-based market like Oicwala. This platform connects borrowers with lenders who offer Islamic finance products. Finally, you could also think about using a personal loan from a friend or member of the family to finance your car purchase. Whatever route you select, remember to do your analysis and evaluate rates earlier than making a decision.

When evaluating car financing options in Australia, Islamic models corresponding to Ijarah and Murabahah stand out for their adherence to Sharia ideas, eschewing interest in favor of ethical monetary transactions. Ijarah operates on a lease-to-own foundation, whereas Murabahah entails the bank’s purchase and subsequent resale of the car at a set revenue margin. While these strategies assure transparency and ethical dealings, they can also pose distinctive challenges, such as restricted availability and doubtlessly higher prices. Understanding these nuances is vital for making an informed decision—let’s explore how these elements would possibly influence your financing selection.

Islamic car financing in Australia provides Muslims ethical and Sharia-compliant choices by way of fashions like Ijarah and Murabahah. These financing methods keep away from using curiosity (riba) and instead function on pre-agreed revenue margins or leasing structures. Transparency, equity, and adherence to Islamic values are paramount, ensuring all transactions are ethical. Providers in Australia supply varied options, with the buyer making regular funds while ownership structure stays clear and compliant with Islamic pointers.

Currently the only way to purchase a car with out paying any curiosity is to try and find a financial institution that may provide an Islamic loan. The downside arises if the car you determine to purchase is greater than the loan requested as it will mean re-applying for the additional borrowing. In the meantime the chances are the car will get offered and you have to start once more. We congratulate you for making the best selection and deciding on the halal residence loan different. Once you could have accomplished and submitted this kind, a dedicated MCCA sales govt will contact you within 1 enterprise day to stroll you through the following stage of your application.

Here is more about Affordable Car Loans for Muslims take a look at the web site. This is the place Murabahah financing, one of the well-liked types of Islamic financing, is useful. If you are over the age of 30 and seeking an ethical, financially safe resolution for your subsequent car purchase, then the world of Halal car finance in Australia may be just the ticket for you. In particular, you would possibly discover a financing method called Murabahah, a standard follow in Islamic finance, to be your best resolution. Once accredited, the financial establishment will buy the car on behalf of the applicant. Instead of paying curiosity, the customer will enter right into a rental settlement with the institution, paying rental instalments until the whole amount is repaid. This construction ensures compliance with Sharia regulation, because it avoids interest-based transactions.

Islamic Car Financing Islamic Financing Options Uif Company

Applicants must provide proof of a stable income enough to cowl the car finance with out resorting to interest-based loans, as these are prohibited underneath Sharia legislation. Additionally, the car being financed have to be for personal use and should not be concerned in any activities deemed haram. It avoids the idea of interest and as a substitute depends on several permissible constructions corresponding to Murabaha, Ijarah, and Musharakah. These buildings are designed to adjust to Islamic law while providing practical financial solutions.

For extra info on Islamic car finance and other Sharia-compliant financial merchandise, go to Sharia Finance. Islamic car loans are structured on ideas that assure monetary transactions remain ethical and Sharia-compliant, offering a transparent and interest-free alternative for automobile financing. Unlike conventional loans, Islamic car finance employs methods such as ijarah finance and cost-plus financing (also known as Murabaha) to make sure compliance with Sharia regulation. Approval criteria for Islamic car finance might differ from standard loans.

Additionally, confirming that the financing is certainly interest-free is important to aligning with ethical and spiritual standards. Our Ijarah method aligns with the Islamic precept of a trade-based arrangement which includes an asset being purchased by the financier after which the shopper pays Rent to use the Asset. At any time in the course of the financing time period, the customer(lessee) can make a suggestion to purchase (Albai) the asset from the financier(lessor). Payments are made as Rental (Ijarah) funds all through the time period and the index price is clearly described as a Rental Rate which is recognised underneath Australian Law & Sharia.

Afterwards, the listing of best banks for car loans in Pakistan is considered on the display. The month-to-month installment, initial deposit (down payment), and processing payment are displayed with the listing of the banks. So, you have to do comprehensive research with the help of our bank car installment calculator before applying. You can get car financing for your desired automobile with the help of the most effective car financing banks in Pakistan. These embody Faysal Bank Limited, MCB Islamic Bank, Dubai Islamic Bank, MCB Bank Limited, Al Barakah Bank Limited, and Bank of Punjab. We offer car financing within the case of both new and used automobiles with low car markup.

This approach ensures transactions are halal and ethically sound, in accordance with Islamic ideas. To comprehend the way it secures both compliance and aggressive benefits, additional details are essential. Initially, establish a reputable broker or monetary institution that offers sharia-compliant Islamic monetary products. These brokers sometimes provide clear guidelines and help throughout the appliance process. Next, submit the required documents, together with proof of revenue, identification, and particulars of the specified car. Understanding Islamic Car Finance begins with recognizing the basic ideas of Sharia legislation that prohibit interest-based transactions and emphasize moral, risk-sharing financial practices.

To finance the car of your selection, ICFAL makes use of Murabaha finance contract. This Islamic contract discloses the price incurred and profit earned during the sale. Once you select a car that you simply want to personal, ICFAL purchases the vehicle from the dealership and sells it to you in installment with a pre-agreed markup.

The funder’s insurers and funder need a valuation report to have the power to assess your software. Paying for a valuation report or for finance processing fee doesn't mean an computerized approval. Initial approval course of which supplies an estimate of how much a potential consumer might receive (before identifying the property to be purchased for the consumer to possess/occupy), based mostly on the data supplied to MCCA. The funder’s insurer or funder can at any time of the application process ask for any info that they deem is required to adapt to their set guidelines. Anyone, Muslim or non-Muslim can apply for finance, however approval of funds is subject to assembly the applicable evaluation standards in drive on the time of software. MCCA’s residential finance product is the leading alternative for Muslims conscious about Shariah necessities relating to their finances.

Driven by our Islamic values and ethos, our Shariah advisors ensure all our products are Shariah compliant. Chose from Islamic car finance on your private or business wants. In addition, the traders are in search of long-term gains and are prepared to simply accept the next stage of market danger and volatility along the way in which. ISRA Consulting as its Shariah Adviser certifies and provides the Shariah Pronouncements of the investments for them to comply with the Shariah Rulebook.

This revenue is transparent and stuck, distinguishing it from interest-based standard loans. Islamic Car Finance provides numerous advantages to Australian residents and traders in search of moral and Sharia-compliant financial options for buying automobiles. As a supplier of halal car finance in Australia, Islamic Car Finance adheres to Islamic finance rules, making certain that each one transactions are ethically sound and compliant with Sharia legislation. Asset-backed Islamic car finance and business asset finance are pivotal tools within Islamic finance, facilitating the acquisition of autos and business property by way of Shariah-compliant financing constructions. In Islamic asset-backed financing, varied modes such as musharakah, mudarabah, and ijarah are commonly utilized to guarantee compliance with Islamic regulation.

Contact us right now and let our professional group help you obtain your financial targets whereas respecting your beliefs. Navigating the journey toward homeownership can seem daunting, particularly when your religion dictates specific financial pointers. A Halal Mortgage is a novel possibility within the Islamic world that enables Muslims to benefit from the luxurious of home ownership whereas being true to their beliefs. Let’s uncover this progressive Islamic finance choice, its operations, and the way the Murabaha transaction flows into the equation. If you’re unsure on whether or not Islamic finance is the proper selection for you and your family, we encourage you to learn by way of our sources. Written by our team of specialists, you’ll get a walkthrough of the ideas of religion primarily based finance and be geared up with all the essentials to grow your private finance knowledge.

Because It Occurred: Residence Loan Lending Slumps, Nation's First Islamic Bank Fails To Get Licence, Asx Closes Larger

Because It Occurred: Residence Loan Lending Slumps, Nation's First Islamic Bank Fails To Get Licence, Asx Closes Larger MCCA’s industrial finance is the perfect alternative for Muslim individuals or businesses trying to harness the ability of Islamic finance to further their targets by way of property buy or investment. Our phrases are aggressive with one of the best finance choices obtainable on the open market. Our car financing product gives you the chance to get your dream car to drive together with your loved ones. Any info is believed to be correct and present at the date of publication. While all care has been taken within the preparation to make sure the information is right, it could change from time to time.

MCCA’s industrial finance is the perfect alternative for Muslim individuals or businesses trying to harness the ability of Islamic finance to further their targets by way of property buy or investment. Our phrases are aggressive with one of the best finance choices obtainable on the open market. Our car financing product gives you the chance to get your dream car to drive together with your loved ones. Any info is believed to be correct and present at the date of publication. While all care has been taken within the preparation to make sure the information is right, it could change from time to time.Get the most recent fee updates, monetary information, insights and analysis delivered weekly. According to the Australian Federation of Islamic Councils, as of 2021, different providers of Islamic house financing include Ijarah Finance, MCCA, Hejaz, Amanah Finance, and ICFAL. It’s important to note that being of Islamic religion just isn't a requirement of these making use of for an Islamic home loan.

The order banning Siddiqui from leaving Australia was needed, ASIC argued, due to issues the ex-company boss was a flight risk, noting his historical past of frequent journey and business links to Dubai. Whilst every effort is taken to ensure that rates are up to date, Arab Bank Australia takes no accountability for errors herein. We have guides and different resources that can assist you apply for a new personal loan or manage your existing one. No penalties whenever you make early repayments or exit fees if you repay your loan sooner.

Sharia-compliant financiers are sure by Australian regulations to indicate merchandise on this means. Before we get into the small print of Sharia-compliant finance merchandise, it's important to note that they’re sometimes not referred to as ‘loans’. However, as the phrases ‘financing’ and ‘lending’ are sometimes used interchangeably throughout the Australian financial space, both terms are used on this article.

The buyer can then repay this amount in installments, making it a sharia-compliant financing possibility. Unlike standard finance, where the borrower bears a lot of the risk, sharia-compliant car financing includes shared threat between the financier and the shopper. This equitable distribution of threat is essential in sustaining the integrity of the monetary transaction according to shariah.

From there, the process is tailor-made particularly to Islam, together with your financial establishment agreeing to buy it for you. In return, you make a Ijarah Muntahiyah Bittamlik or ‘lease’ agreement to live in the property for an agreed size of time and pay rent to the establishment. One of the most important traits of Islamic financing is that it's asset-backed and asset based financing. The conventional / capitalist idea of financing is that the banks and financial institutions deal in money and financial papers solely. That is why they are forbidden, in most international locations, from trading in items and making inventories.

The revenue that the funder puts on high of the asset’s buy price is for the companies and costs incurred by the funder to safe and purchase the asset. The client will make regular funds to the funder till the acquisition value plus profit margin has been repaid. As with Ijarah agreements, the client does not become the owner until after the finance has been paid in full.

Islamic Residence Loans Study And Examine

They shouldn't be relied on by individuals once they make funding decisions. Provide application documents which will be checked and despatched to credit score manager for approval. Unfortunately, we will ONLY finance for self-employed clients who've an ABN which is trading. We are endeavoring to have a client finance product in January 2025 to fulfill this additional demand Insha’Allah. We are unable to finance vehicles for Uber or Ride Share automobiles, laser hair removal machines (except for Medical Doctors or specialist Skin Clinics), and gym equipment. At Halal Loans, our dedication to excellence goes past words – it’s reflected within the rave reviews from our happy clients.

A residual value is the worth of the car on the finish of the lease time period. The residual value is agreed whenever you take out a novated lease and is used to calculate the month-to-month lease fee. When you choose your car, TFM will advocate a residual value that takes into consideration the make, model and estimated usage.

Our easy asset finance loans will get you behind the wheel quick. Once we’ve verified your data, we’ll give you the loan documentation setting out your rate of interest and other essential info. Keep in mind that the speed proven within the loan documentation is subject to change and could additionally be totally different on the day of settlement. Choose from one to seven years, with weekly, fortnightly or month-to-month repayment choices.

By choosing a respected Islamic finance supplier, Australian residents can safe car financing that meets their religious and monetary requirements. We’re partnered with lenders, insurers and different financial establishments who compensate us for business initiated via our website. We earn a fee every time a buyer chooses or buys a product advertised on our web site, which you'll find out more about right here, in addition to in our credit information for asset finance.

Asset-backed financing serves as an essential instrument in Islamic finance, enabling individuals and companies to entry the mandatory funds with out resorting to interest-based transactions. This type of financing promotes monetary inclusion and economic growth within the framework of Islamic finance principles. You don’t should pay curiosity utilizing the standard PCP or HP, this way.

Accounts, Commerce Finance, Loans, International Trade

Please discuss with our present Personal Banking Booklet (PDF, 1.50 MB) for full particulars. Contact Arab Bank Australia to debate your needs and eligibility for a private loan today. The tech stocks Australia does have have been usually performing well (+0.8%), while healthcare and shopper shares have been additionally solidly greater. Wall Street posted reasonable positive aspects in a single day, and without a massive tech sector, which again drove some of the better rises, Australia's share market is making an much more modest advance. The female participation rate — that is the number of ladies either employed or unemployed as a share of the labour market — is 62.6 per cent, nonetheless lower than the 71.1 per cent for males.

In Islamic finance, interest-bearing transactions are prohibited, as the charging and receiving of interest is con... The concept of empowering communities via moral monetary options has gained vital attention in current years. Ethical financial options goal to not only address the monetary needs of individuals and companies but additionally contemplate the br...

You might want to show that you’re good at managing cash and that you've saved money successfully up to now (which can embrace cash saved in your deposit). The lender will need to be persuaded that your revenue is sufficient to repay the loan over the time period you want. Bear in thoughts that your selection isn't restricted to financial institution based in predominantly Islamic nations. Some of the larger Australian banks additionally provide Sharia-compliant loans.

Financial inclusion is a crucial element for economic development and social progress. It ensures that people and communities have access to the necessary financial tools and assets to enhance their lives and participate totally within the econo... Islamic banking, also identified as Shariah-compliant banking, is a quickly rising sector within the international monetary trade. With an estimated market worth of over $2 trillion, it has gained important attention from both Muslim and non-Muslim consum... Empowering people via monetary education is a vital step towards making a extra financially secure society.

Islamic finance principles, which adhere to the ideas of Shariah law, are more and more being acknowledged as an ethical and sustainable... Sustainable infrastructure improvement is crucial for achieving financial development while safeguarding ethical rules. In recent years, there was a growing recognition of the want to finance infrastructure projects that promote environmental sus... Empowering Rural Communities by way of Islamic Financing SolutionsRural communities in many Islamic nations typically face challenges when it comes to accessing monetary services and sources. Halal financing has emerged as a robust software for empowering Muslim entrepreneurs and unlocking their full potential. By adhering to Islamic principles and avoiding interest-based transactions, Halal financing provides a viable various to tradit...

This aligns with the rules of Sharia law, permitting people to acquire properties without compromising their spiritual beliefs. Initiating the applying process for Islamic car financing requires an intensive understanding of the needed documentation and compliance necessities to ensure adherence to sharia rules. Prospective candidates should first choose a respected car finance provider specializing in sharia compliant finance. Key documents typically embody proof of income, identification, and details of the vehicle to be financed. In conclusion, the concept of Halal Mortgage presents a singular perspective on home financing by aligning with Islamic rules such as equity participation and avoiding interest-based transactions. Understanding these elementary rules is crucial in reaching homeownership by way of Halal Mortgage, which entails distinctive structures and processes.

Islamic Funding Finance Riyadh Islamic Finance

Ali has a wealth of information in residential lending, serving to people and families buy homes and grow investment property portfolios. He is very regarded for his customer service, establishing himself as a friendly and helpful lender. By joining IFIA, you become a part of the founding affiliation committed to shariah compliant asset-based or asset-backed monetary products. IFIA is founded and controlled by key issuers and practitioners who're regulated by compliance frameworks and have Shariah-compliant boards or certifications. Some of Australia’s biggest banks offer Sharia-compliant finance merchandise.

The 10% deposit just isn't required to be paid in till you've obtained a formal approval letter from MCCA. This letter ensures that the finance application has been accredited by all parties to the stated finance facility. MCCA’s residential finance product is the leading alternative for Muslims conscious about Shariah requirements relating to their funds. With no early termination charge and a range of suitable options, it's the finance product to suppose about if you're looking to fulfil your property-ownership targets. The Ijarah Muntahia Bittamleek arrangement has been recognised by a lot of up to date Muslim scholars and is broadly carried out and utilised by Islamic banks and financial institutions around the globe. For nearly a decade, we now have been amalgamating wealth with faith to advance financial development and financial opportunity for all Muslims.

Islamic nations have significant potential for financial growth, and opening new doors to facilitate this progress is of significant importance. One such avenue is the growth of investment opportunities in Halal finance. Ethical financing is a concept that has gained vital attention in recent times as people and organizations attempt to align their monetary activities with their moral and ethical values.

This niche market continues to expand, permitting Muslims to entry companies that align with their religious beliefs. By opting for Islamic car loans in Australia, individuals can fulfill their car possession needs without compromising their religion. As the demand for Sharia-compliant financing grows, extra establishments are prone to offer tailor-made Islamic finance options, contributing to the accessibility and availability of halal monetary choices. Sharia-compliant financing choices provide people a financially moral various within the field of car financing. In Australia, not solely is Islamic car financing is gaining traction, however halal mortgages and sharia mortgages are growing exponentially.

Interest is all over the place – it's tied to residence loans, deposit accounts, bank cards, and is meticulously manipulated by our own central bank. Islamic rules play a big role in shaping the practices of economic transactions for Muslims. However, adhering to those rules can often be difficult because of numerous roadblocks.

Mcca Islamic House Finance Australia Shariah Compliant Halal Finance Muslim Mortgage

The primary eligibility criteria revolve across the applicant’s financial stability and adherence to halal practices. Applicants should present proof of a stable income adequate to cowl the car finance without resorting to interest-based loans, as these are prohibited under Sharia legislation. Additionally, the car being financed must be for private use and shouldn't be involved in any actions deemed haram. Alternatively, in cost-plus financing, the financial institution buys the automobile and sells it to the shopper at the next value, which features a predetermined revenue margin. The buyer can then repay this amount in installments, making it a sharia-compliant financing option. By selecting Halal Mortgage Australia, you're partnering with a company that prioritizes compliance with the highest standards of Islamic finance.

Ijarah Finance operates beneath the principle of Rent-To-Own in any other case generally identified as Ijarah Muntahiya Bit Tamleek – A Lease Agreement with the option to own the leased asset at the end of the lease interval. Buying the car in installment utilizing a halal contract lets you own a car comfortable. Putting Shariah compliance first with none compromise on islamic rules. As you navigate your monetary journey, I encourage you to dig deeper, ask questions, and seek out financial options that align along with your faith and values.

In this weblog post, we’ll discover some of the challenges and potential options for halal car financing. These banks observe Sharia law and provide products which are compliant with Muslim values. Another possibility is to finance your car by way of a web-based market like Oicwala. This platform connects borrowers with lenders who offer Islamic finance products. Finally, you could also think about using a personal loan from a friend or member of the family to finance your car purchase. Whatever route you select, remember to do your analysis and evaluate rates earlier than making a decision.

When evaluating car financing options in Australia, Islamic models corresponding to Ijarah and Murabahah stand out for their adherence to Sharia ideas, eschewing interest in favor of ethical monetary transactions. Ijarah operates on a lease-to-own foundation, whereas Murabahah entails the bank’s purchase and subsequent resale of the car at a set revenue margin. While these strategies assure transparency and ethical dealings, they can also pose distinctive challenges, such as restricted availability and doubtlessly higher prices. Understanding these nuances is vital for making an informed decision—let’s explore how these elements would possibly influence your financing selection.

Islamic car financing in Australia provides Muslims ethical and Sharia-compliant choices by way of fashions like Ijarah and Murabahah. These financing methods keep away from using curiosity (riba) and instead function on pre-agreed revenue margins or leasing structures. Transparency, equity, and adherence to Islamic values are paramount, ensuring all transactions are ethical. Providers in Australia supply varied options, with the buyer making regular funds while ownership structure stays clear and compliant with Islamic pointers.

Currently the only way to purchase a car with out paying any curiosity is to try and find a financial institution that may provide an Islamic loan. The downside arises if the car you determine to purchase is greater than the loan requested as it will mean re-applying for the additional borrowing. In the meantime the chances are the car will get offered and you have to start once more. We congratulate you for making the best selection and deciding on the halal residence loan different. Once you could have accomplished and submitted this kind, a dedicated MCCA sales govt will contact you within 1 enterprise day to stroll you through the following stage of your application.

Here is more about Affordable Car Loans for Muslims take a look at the web site. This is the place Murabahah financing, one of the well-liked types of Islamic financing, is useful. If you are over the age of 30 and seeking an ethical, financially safe resolution for your subsequent car purchase, then the world of Halal car finance in Australia may be just the ticket for you. In particular, you would possibly discover a financing method called Murabahah, a standard follow in Islamic finance, to be your best resolution. Once accredited, the financial establishment will buy the car on behalf of the applicant. Instead of paying curiosity, the customer will enter right into a rental settlement with the institution, paying rental instalments until the whole amount is repaid. This construction ensures compliance with Sharia regulation, because it avoids interest-based transactions.

Islamic Car Financing Islamic Financing Options Uif Company

Applicants must provide proof of a stable income enough to cowl the car finance with out resorting to interest-based loans, as these are prohibited underneath Sharia legislation. Additionally, the car being financed have to be for personal use and should not be concerned in any activities deemed haram. It avoids the idea of interest and as a substitute depends on several permissible constructions corresponding to Murabaha, Ijarah, and Musharakah. These buildings are designed to adjust to Islamic law while providing practical financial solutions.

For extra info on Islamic car finance and other Sharia-compliant financial merchandise, go to Sharia Finance. Islamic car loans are structured on ideas that assure monetary transactions remain ethical and Sharia-compliant, offering a transparent and interest-free alternative for automobile financing. Unlike conventional loans, Islamic car finance employs methods such as ijarah finance and cost-plus financing (also known as Murabaha) to make sure compliance with Sharia regulation. Approval criteria for Islamic car finance might differ from standard loans.

Additionally, confirming that the financing is certainly interest-free is important to aligning with ethical and spiritual standards. Our Ijarah method aligns with the Islamic precept of a trade-based arrangement which includes an asset being purchased by the financier after which the shopper pays Rent to use the Asset. At any time in the course of the financing time period, the customer(lessee) can make a suggestion to purchase (Albai) the asset from the financier(lessor). Payments are made as Rental (Ijarah) funds all through the time period and the index price is clearly described as a Rental Rate which is recognised underneath Australian Law & Sharia.

Afterwards, the listing of best banks for car loans in Pakistan is considered on the display. The month-to-month installment, initial deposit (down payment), and processing payment are displayed with the listing of the banks. So, you have to do comprehensive research with the help of our bank car installment calculator before applying. You can get car financing for your desired automobile with the help of the most effective car financing banks in Pakistan. These embody Faysal Bank Limited, MCB Islamic Bank, Dubai Islamic Bank, MCB Bank Limited, Al Barakah Bank Limited, and Bank of Punjab. We offer car financing within the case of both new and used automobiles with low car markup.

This approach ensures transactions are halal and ethically sound, in accordance with Islamic ideas. To comprehend the way it secures both compliance and aggressive benefits, additional details are essential. Initially, establish a reputable broker or monetary institution that offers sharia-compliant Islamic monetary products. These brokers sometimes provide clear guidelines and help throughout the appliance process. Next, submit the required documents, together with proof of revenue, identification, and particulars of the specified car. Understanding Islamic Car Finance begins with recognizing the basic ideas of Sharia legislation that prohibit interest-based transactions and emphasize moral, risk-sharing financial practices.

관련자료

-

이전

-

다음

댓글 0개

등록된 댓글이 없습니다.