Gold As A Safe Haven Fundamentals Explained

작성자 정보

- Rory 작성

- 작성일

본문

Investors ought to rigorously consider their investment goals and risk tolerance when deciding on the most effective safe haven assets for their portfolio. Whether you're a seasoned investor or just starting out, understanding the advantages of valuable metals can enable you make informed funding decisions. Precious metals typically have a low correlation to different asset lessons comparable to stocks and bonds, which may also help reduce total portfolio threat. This unfavourable correlation may also help offset losses in different asset lessons, providing a level of portfolio protection. In case you are particularly pessimistic, then you could be anxious that the central financial institution will introduce destructive curiosity charges on savings. The regular interest payments offered by government bonds and treasury securities can function a stable source of earnings, significantly for retirees or those seeking to complement their present earnings streams. For example, throughout occasions of accommodative financial coverage, the place interest rates are low and money provide is excessive, there may be an elevated threat of inflation. This meant that the value of paper money was instantly linked to the value of gold. Sustain with costs by following an online gold coin price guide. On the contrary, if you personal some blue-chip stocks, which pay excessive dividends, even when inventory value remains at the same degree, you could have a chance to outperform inflation fee (however after all you would possibly still lose, due to a drop in stock value).

What good are gold bars at the bank, and even at dwelling, for that matter? 4. Diversify your storage: Consider storing your gold in multiple locations, such as at home and in a secure storage facility. If gold acts as a true safe haven, we might expect only a few, if any, such observations. 3. Limited Supply: Another factor that contributes to gold's safe haven status is its limited provide. Its ability to preserve worth, provide diversification, restricted supply, global acceptance, psychological enchantment, and historical performance make it an attractive choice for investors trying to hedge towards inflation and market turbulence. 1. Throughout history, gold has been used as a hedge in opposition to inflation. As Willem Buiter defined in the Financial Times, gold is a fiat commodity: its price is almost solely pushed by speculative demand and provide, by way of traded devices. This international acceptance ensures that gold can be easily purchased, bought, and traded across totally different markets, making it a extremely liquid asset. Is bodily gold inflation-proof? Additionally it is vital to dispose of Fool's Gold responsibly to prevent environmental harm. Therefore, it is important to handle Fool's Gold responsibly and dispose of it correctly. The current spot gold price often determines what consumers offer, which suggests the worth of a gold coin fluctuates.

What good are gold bars at the bank, and even at dwelling, for that matter? 4. Diversify your storage: Consider storing your gold in multiple locations, such as at home and in a secure storage facility. If gold acts as a true safe haven, we might expect only a few, if any, such observations. 3. Limited Supply: Another factor that contributes to gold's safe haven status is its limited provide. Its ability to preserve worth, provide diversification, restricted supply, global acceptance, psychological enchantment, and historical performance make it an attractive choice for investors trying to hedge towards inflation and market turbulence. 1. Throughout history, gold has been used as a hedge in opposition to inflation. As Willem Buiter defined in the Financial Times, gold is a fiat commodity: its price is almost solely pushed by speculative demand and provide, by way of traded devices. This international acceptance ensures that gold can be easily purchased, bought, and traded across totally different markets, making it a extremely liquid asset. Is bodily gold inflation-proof? Additionally it is vital to dispose of Fool's Gold responsibly to prevent environmental harm. Therefore, it is important to handle Fool's Gold responsibly and dispose of it correctly. The current spot gold price often determines what consumers offer, which suggests the worth of a gold coin fluctuates.

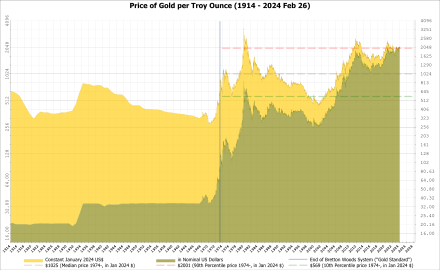

While it could also be true that within the very lengthy run the worth of gold is stable (disputable), gold can have sturdy fluctuations in worth. Gold is usually considered the go-to asset to protect towards inflation and market downturns. When the stock market crashes or when there may be political instability, traders usually flock to gold as a safe haven asset. 3. Cryptocurrency: While nonetheless a relatively new asset class, cryptocurrencies like Bitcoin have gained recognition as a protected haven asset. Members can have subscription-based access to free games ranging from top hits to breaking indie stars. On the other hand, a secure deposit box can be a secure option, but it might involve charges and restrictions on access. This liquidity gives traders with the flexibility to entry their funds when needed, including a further layer of safety to their funding. 1. The 1/10 Year Treasury bond has traditionally supplied a comparatively stable return, making it a beautiful funding for danger-averse investors.

Government bonds and treasury bills are highly liquid property, meaning that they are often easily purchased and offered in the secondary market. Government bond issuances are subject to strict regulatory standards, and the monetary well being of the issuing government is often transparent and readily out there to traders. Alternatively, unwell-considered makes an attempt by the federal government to sustain public spending would possibly trigger hyperinflation. Sulfur dioxide fuel is a toxic fuel that can cause respiratory issues. By considering the insights from different factors of views, investors could make knowledgeable decisions about whether or not gold is the fitting investment alternative for them. Check out some historic gold prices and US inflation charges. A blanked statement that "gold is inflation proof" would not stack up historically - one can choose varied pairs of time limits to show gold rising as costs rise; or gold falling as costs rise. The inflation price gold for the interval from 1980 through 2001 was 3.9 %.

If you have any questions concerning where and how to use سعر الذهب اليوم في عمان, you can call us at our own web-site.

관련자료

-

이전

-

다음