Understanding The Operating Lease Benefits For Businesses

작성자 정보

- Valerie 작성

- 작성일

본문

Operating leases enable companies to deal with lease payments as an expense, making them tax-deductible. This characteristic considerably reduces the tax burden for corporations, allowing for better money flow administration. By categorizing these payments as operational expenses, companies can decrease their taxable earnings. 50,000 yearly for leased tools, this quantity is deducted directly from its revenue, reducing the general tax obligation. This deduction provides an immediate financial benefit, enhancing liquidity to reinvest in core operations or pursue progress alternatives. Additionally, the tax-deductible nature of working lease funds encourages companies to have interaction in leasing fairly than purchasing assets outright.

Technically you'll be able to reward your own home to your kids and nonetheless reside in it as long as you pay rent underneath a formal settlement. But, bear in thoughts, that the property will now not be yours and your youngsters will likely be liable to capital good points tax on any gain within the property worth from the purpose that they acquire it. In different words, the lender wants to affirm that ownership will be totally transferred in the course of the sale. The lender will then full the following documentation:- The safety agreement that may permit the lender to repossess the aircraft if the borrower defaults on the loan (i.e., オペレーティングリース 節税スキーム fails to pay). The promissory word that can hold the borrower chargeable for any excellent loan balance that can not be coated via the repossession of the aircraft.

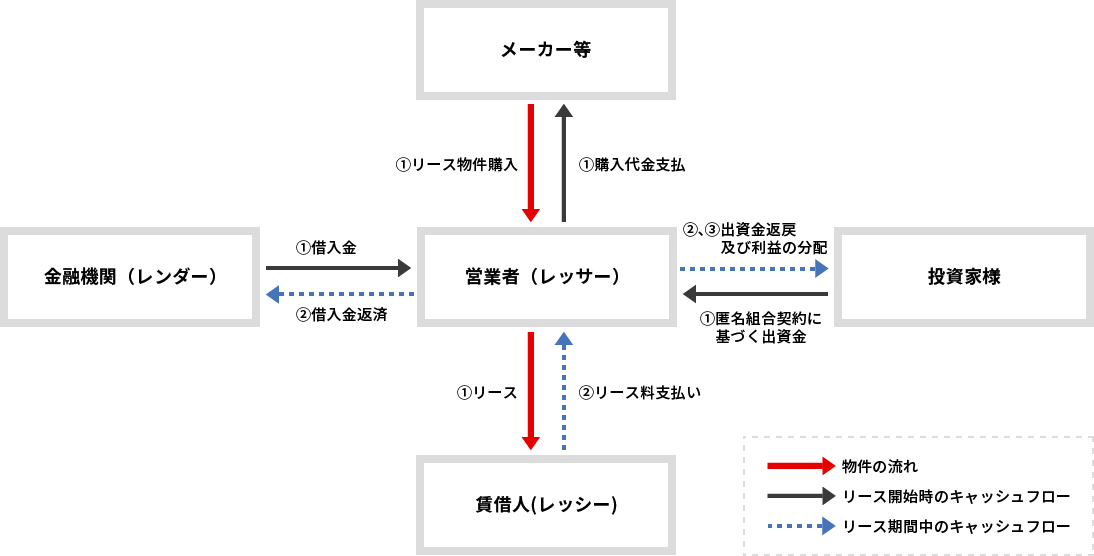

Keep informed about related laws to keep away from compliance points. Consider the practicality of implementing totally different strategies when choosing a depreciation method. The straight-line methodology is the best to calculate and monitor, making it a easy choice for many companies. Strategies like items of manufacturing require extra detailed record-maintaining and calculations, which can enhance administrative complexity. For efficient solutions to simplify your monetary administration duties, consider exploring the very best tracker for enterprise expenses. Trendy accounting software program provides powerful features for depreciation calculation and tracking. These instruments can automate complex calculations, lowering the risk of human error and saving time. Monitoring enterprise bills, together with depreciation, may be made simpler with accounting software. This software program may be a useful device for managing your company’s financial information. Leveraged leases regularly provide lessors and lessees favorable tax treatment. Renters can make the most of depreciation tax shields and infrequently declare the deduction of lease funds as working bills. Lease agreements might be tailored to each party’s unique requirements, considering duration, cost plans, and choices for purchasing the asset at the end of the lease.

2. steadiness Sheet administration: By not showing as a liability on the balance sheet, working leases do not affect an organization's debt-to-fairness ratio, which is a key metric for buyers and credit ranking companies. Three. Cost Predictability: Lease payments are typically fixed, making it simpler for firms to predict and manage their future costs, aiding in lengthy-term budgeting and monetary planning. A lessor should have a deep understanding of the assets being leased, as effectively as the trade wherein the lessee operates. This expertise may help the lessor present precious insights and recommendation to the lessee. Four. financial stability: The monetary stability of the lessor can also be an necessary consideration when choosing a lessor for an operating lease. Determine 2 shows that the fiscal advantages of a tax minimize or abolition would be concentrated among the many wealthiest. Observe: Each ventile is 5% of the distribution of those dying, ordered by wealth bequeathed. We exclude the primary member of married and civil-partnered couples to die, who're assumed to move all wealth to their associate at loss of life. For details of methodology, see Advani and Sturrock (2023). Values in 2023-24 costs. Supply: Authors’ calculations utilizing the Wealth and Assets Survey. We also can view the advantages from the aspect of those receiving inheritances. Amongst those born within the 1970s and early 1980s, those that attended college have been more than 10 occasions extra prone to have dad and mom within the wealthiest fifth than those who had solely up to compulsory ranges of training. Nearly all inheritance tax is paid by those with dad and mom within the wealthiest fifth. Therefore, we'd expect that in the coming years and a long time, as a whole, graduates would gain around 10 occasions extra from any reduce to inheritance tax than those with only up to GCSEs or equal.

관련자료

-

이전

-

다음