Tax Planning: What It is, How It really works, And Greatest Methods

작성자 정보

- Marita 작성

- 작성일

본문

Earned Earnings Tax Credit score (EITC) for workers whose earned earnings is lower than a threshold determined by the IRS based on filing standing and variety of dependents. Clear car tax credit for the acquisition of qualifying electric vehicles. Vitality efficiency tax credits for the purchase of items that make your house extra energy-efficient. A 529 plan, or certified tuition program, is a tax-advantaged education financial savings account. HSAs are triple tax-advantaged, which means they are tax-deductible, contributions grow tax-free and distributions are tax-free when used for certified medical expenses. HSAs are a superb solution to develop financial savings as contributions will be invested like with a 401(ok) and might develop tax-free for future medical expense use. Donating to charity is an efficient course of action to assist causes you care about however it’s also an efficient strategy for lowering your tax burden. One technique for saving on taxes when donating to charity is donating appreciated equities or mutual fund shares, lowering capital features taxes and incomes a charitable deduction. Another donation technique is contributing to a donor-suggested fund (DAF) to expertise a tax deduction even should you disburse funds from the DAF to selected charities sooner or later.

These changes and their effects should be supported earlier than 12 months end and documented contemporaneously. Have all cross-border transactions been recognized, priced and correctly documented, together with transactions resulting from merger and acquisition activities (as well as internal reorganizations)? Are you aware which entity owns intellectual property (IP), the place it's located and who's benefitting from it? Companies must consider their IP property — each self-developed and acquired by transactions — to make sure compliance with native country transfer pricing guidelines and to optimize IP administration methods. Below a composite filing, the entity remits the tax on behalf of the individual, and the person often no longer has a state filing requirement. Be aware the federal remedy for each cost sorts is categorised as an proprietor distribution and never an entity deduction. Composite tax rates are sometimes at the state’s highest personal marginal tax price, which are typically larger than the circulate-by means of withholding charges or particular person nonresident rate if filed personally. Be significantly cautious when contemplating composite filings in states corresponding to California and New York, which have very excessive composite tax rates. It may still be beneficial to elect state composite filings, when an entity has numerous qualifying nonresident house owners.

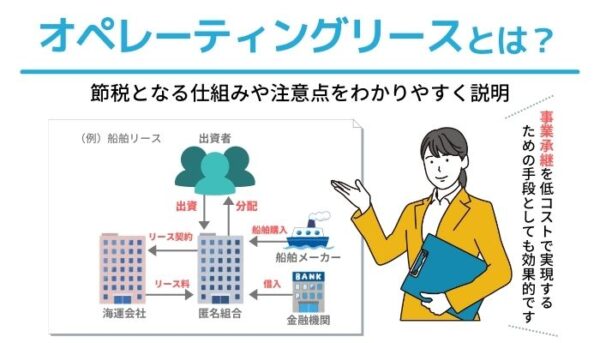

The primary consideration is utilizing the aircraft to its maximum operational capability according to the client’s wishes without violating any FAA or IRS laws and insurance provisions. This requires full data of precisely what every get together wants to do with the aircraft within the limitations of those laws and provisions. In accordance with the previous consideration, it’s crucial to understand the relevant FAA, IRS and insurance requirements to make sure that homeowners are in a position to function the aircraft as they want. The phrases and conditions of the lease are outlined in the lease agreement. What are the forms of leasing? The kinds of leasing are: 1. Operating Lease 2. Financial Lease 3. Sale and Lease Back four. Leveraged Lease 5. Main and Secondary Lease. What are some great benefits of leasing? The next are the points advantages of leasing: Easy Supply of Finance 2. Shifting Threat of Obsolescence 3. Increases Liquidity four. Maintenance and Specialised Companies 5. Comfort and flexibility. What are the disadvantages of leasing? The disadvantages of leasing are: Unhealthy Competition 2. Lack of Qualified Personnel 3. Stamp Responsibility 4. Tax Concerns 5. Delayed Payment and Bad Debts.

We consider we can assist you keep more of your cash invested and dealing for you. To help achieve that objective, we've developed a complete, tax-smart method,1 which we apply throughout the year, that goes past buying tax-environment friendly investments or オペレーティングリース リスク conducting yr-finish tax-loss harvesting. Already have a Fidelity advisor? Looking to maintain more of what you earn? 24,050 inheritance tax due. 200,000 money to Norman whereas David remains to be dwelling. As long as such reward is made greater than three years earlier than David’s dying (i.e., on or earlier than December 30, 2019), no Nebraska inheritance tax is due on the reward to Norman. 200,000 complete). None of the pre-death gifts to Norman are subject to Nebraska inheritance tax.

Capital leases enable lessees to say depreciation on the leased asset, which will be a major tax benefit. For instance, a company that enters right into a capital lease for manufacturing gear can deduct the depreciation of that equipment over its useful life, reducing taxable income. The interest component of capital lease payments can be deductible. 2,000 could be deducted as a enterprise expense.

관련자료

-

이전

-

다음